- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Professional analysis: Automotive accessoriesImport RepresentationOpportunities and challenges - 20 years of industry experience shared in depth

As a senior consultant who has been deeply engaged inforeign tradeservice expert with 20 years of industry experience, this article will systematically analyze the core points of clothingExport RepresentationAs a practitioner with 20 years of experience, I have witnessed the rapid development of Chinas automotive consumer market and the iterative upgrades in the imported automotive accessories industry. From the early days of single model introductions to todays diversified demands covering modification parts, smart accessories, premium interiors, and personalized custom products, automotive accessories import agency has evolved from a niche track to a blue ocean market with enormous potential. This article will provide systematic references for practitioners from dimensions such as industry status, core processes, risk avoidance, and future trends.

Industry status: Demand upgrades create new market opportunities

1.Consumption trend drivers

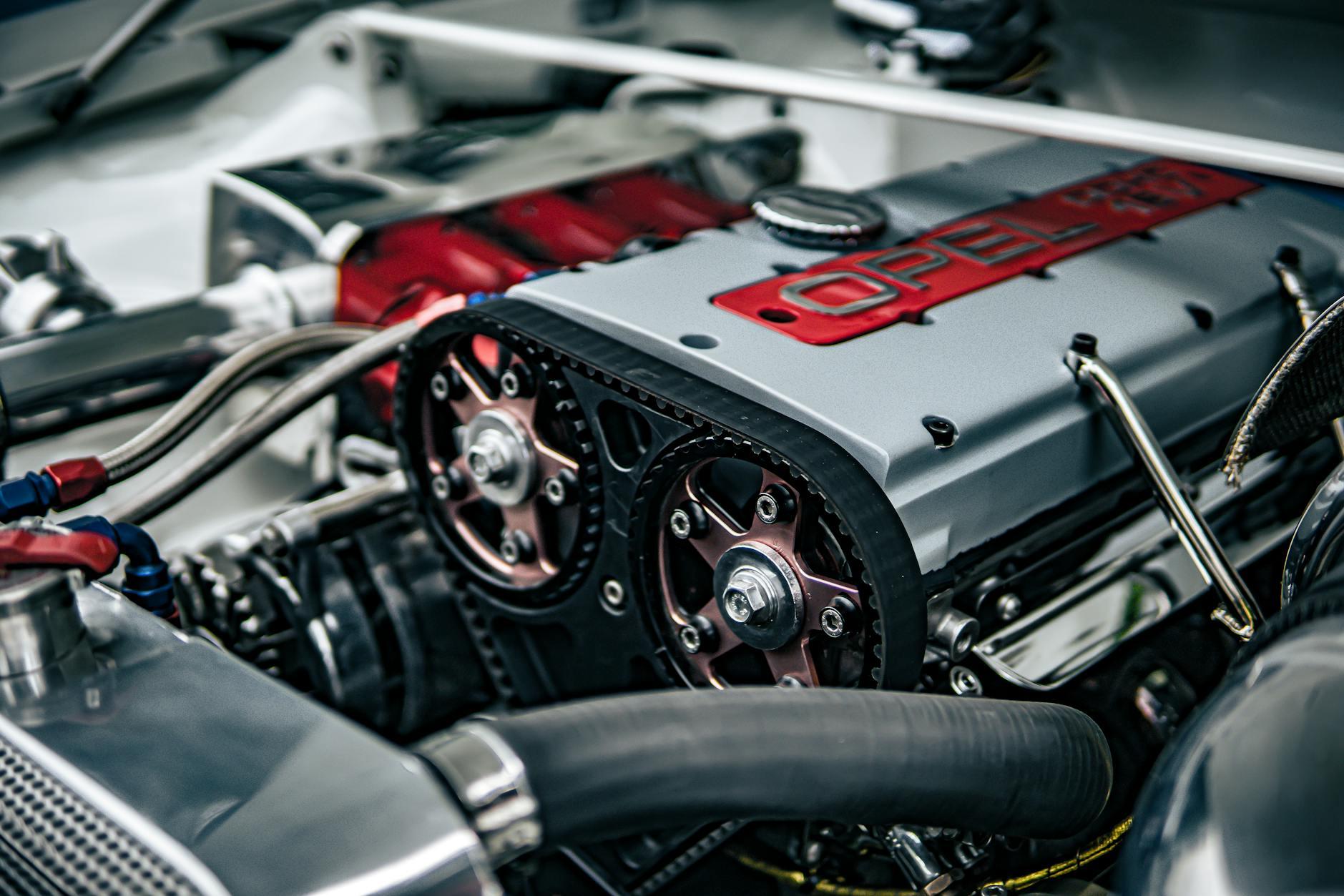

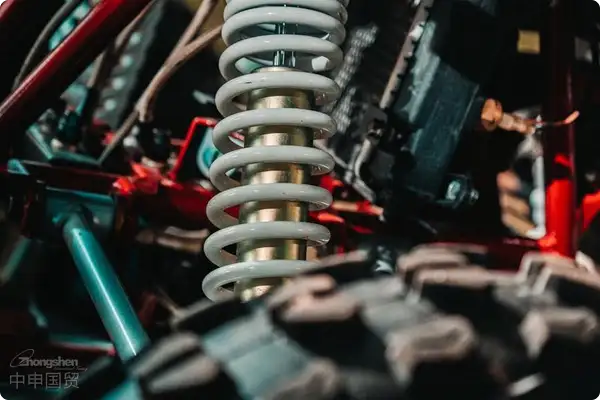

With Chinas car ownership exceeding 340 million vehicles (as of 2023), car owners demand for personalized and functional automotive accessories continues to rise. Data shows that in 2023, Chinas automotive modification market size exceeded 160 billion yuan, with imported accessories accounting for 35%, covering categories such as performance modification parts (e.g., exhaust systems, shock absorbers), smart vehicle devices (HUD displays, autonomous driving kits), and premium interiors (leather seats, carbon fiber panels).

2.Policy dividend release

China continues to expand its imported goods catalog, implementing tariff preferences for automotive accessories that meet environmental and safety standards. For example, import tariffs on someNew energyvehicle modification parts have been reduced from 10% to 5%,Cross-border E-commercethe policy also provides convenience for small and medium batch procurement.

Core service processes for automotive accessories import agency

Preliminary market analysis and product selection

- Precise demand positioning: Conduct consumer preference research for target markets (e.g., premium car owners, modification enthusiasts, new energy vehicle owners). For instance, southern China prefers exterior modification parts, while first-tier cities focus more on smart driving accessories.

- Compliance screening: Key verification of whether products comply with Chinas compulsory certification (CCC), environmental standards (e.g., VOC emissions), and vehicle consistency certification. For example, EU EC-certified modification parts require additional matching with national standard GB/T requirements.

Supply chain integration and cost optimization

- Global procurement network: Establish direct procurement channels with overseas brands and first-tier agents to avoid middleman markups. A typical case: A German shock absorber brand reduced costs by 18% through direct agency procurement.

- Customized Logistics Solutions: Select based on cargo value and delivery time requirementsMaritime TransportationFCL (low cost),Air Transportation(high speed) orChina-Europe Railway Express(balanced cost performance). Precision instruments require constant temperature and humidity containers to avoid transportation damage.

Customs clearance and tax compliance

- Classification and valuation: Accurately declare HS codes (e.g., automotive parts under 8708.99 items) to avoid port delays or fines due to classification errors. For example, in-vehicle smart devices need to be distinguished between communication equipment and ,Automotive partscategories.

- : Offer comprehensive after-sales service to improve customer satisfaction.: Utilize the bonded warehousing policy in free trade zones to defer tariff payments, or obtain tariff reductions through RCEP agreements based on rules of origin.

Localized service extension

- Warehousing and Distribution: Establish forward warehouses in bonded zones to achieve 72-hour express delivery;

- After-sales Support: Provide product installation guidance, warranty services, and return/exchange channels to enhance end-user experience.

III. Risk Mitigation: Three Key Points in Agency Business

1.: Legal risk refers to the risk that the agent suffers losses due to legal issues such as contract disputes and intellectual property disputes. The agent should strengthen the study of laws and regulations, abide by laws and regulations, and avoid legal risks.

- Intellectual property verification: Strictly prohibit importing infringing products (such as counterfeit wheel hubs or knockoff vehicle systems). Require suppliers to provide brand authorization letters and patent certificates.

- Regulatory Updates Tracking: For example, starting in 2024, China has implemented new data security certification requirements for imported automotive electronics.

2.Supply Chain Risks

- Pre-shipment Quality Inspection: Commission third-party agencies (such as SGS) to conduct pre-arrival inspections to avoid returns caused by batch quality issues.

- Alternative Supplier Mechanism: Develop 2-3 backup suppliers for core product categories to prevent sudden supply disruptions.

3.: Market risk refers to the risk that the agent cannot achieve the expected revenue due to market changes. The agent should pay close attention to market changes, adjust the business strategy in a timely manner, and reduce market risks.

- Small trial orders: For new product categories, its recommended to test market response with small orders under $5,000 for initial imports.

- Inventory Turnover Monitoring: Use ERP systems to set inventory warning thresholds and promptly clear stagnant products through cross-border platforms.

IV. Typical case analysis

Case Background: A case example: An agency company introduced German smart charging equipment for domestic new energy vehicle manufacturers

- Challenges: The products must simultaneously comply with Chinas GB/T 20234 charging interface standard and EU CE certification.

- Solutions:

- Jointly completed compatibility testing with Sino-German testing institutions

- Adopted the bonded R&D model to conduct adaptation modifications in the free trade zone

- Completed the first customs clearance through cross-border e-commerce B2B model, saving 30% in tariff costs

- Achievements: Achieved 300% order volume growth within 6 months, capturing 15% market share in the niche segment

Future Trends: Intelligence and Green Initiatives Lead Industry Transformation

1.Surge in new energy supporting products: Rapid demand growth for charging piles, battery cooling systems, and lightweight modification parts

2.Upgrades in smart connected devices: Annual import growth rate exceeding 40% for AR-HUD and autonomous driving perception modules

3.ESG orientation: Eco-friendly materials (such as plant-based leather) and carbon footprint certification becoming import thresholds

Conclusion

The essence of automotive premium import agency lies in professional services that achieve efficient connection between global resources and local demand. Practitioners need to build full-chain capabilities encompassing market insight - supply chain management - compliance services - risk control to stand out in competition. As Chinas automotive consumer market continues to upgrade, this field will continue to release significant value space.

(Note: Data in this article is cited from China Association of Automobile Manufacturers, General Administration of Customs, and industry white papers, with cases anonymized.)

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912